JAFZA Gratuity Calculator and Rules For 2025

If you’re working in JAFZA, understanding your gratuity rights is important because it is what you’ve earned after years of effort. With the updated 2025 rules, things are a little clearer but also a bit more detailed, especially when it comes to limited and unlimited contracts. That’s where the JAFZA gratuity calculator comes in handy. Instead of guessing or digging through legal jargon, you can quickly figure out the amount you’re entitled to in just a few steps.

Introduction to JAFZA and End-of-Service Benefits

Before we dive into the numbers, it’s important to understand what JAFZA is and why the gratuity system exists as a cornerstone of end-of-service benefits in the UAE.

What is JAFZA (Jebel Ali Free Zone)?

Jebel Ali Free Zone (JAFZA) is one of the world’s largest free zones. Located in Dubai, it’s a major hub for international trade and logistics, hosting thousands of companies and a diverse workforce. As a free zone, JAFZA operates under its own set of rules and regulations, though they are closely aligned with the UAE Federal Labour Law.

Understanding Gratuity in JAFZA

Gratuity is a monetary payment that an employer is legally required to pay an employee at the end of their service. It is essentially a “thank you” for your service and is calculated based on your length of employment and the last basic salary. It’s a vital component of your end-of-service benefits. While the principles of gratuity are the same across the UAE, free zones like JAFZA can have specific implementations of the law, which makes understanding the JAFZA-specific rules essential. For employees in JAFZA, understanding your end-of-service benefits is crucial, and it’s also helpful to know about other forms of compensation, such as the key differences between gratuity and tips.

JAFZA Gratuity Eligibility

Not everyone is automatically entitled to a gratuity payment. This section outlines the specific criteria you must meet to be eligible for this end-of-service benefit.

Who is Eligible for Gratuity in JAFZA?

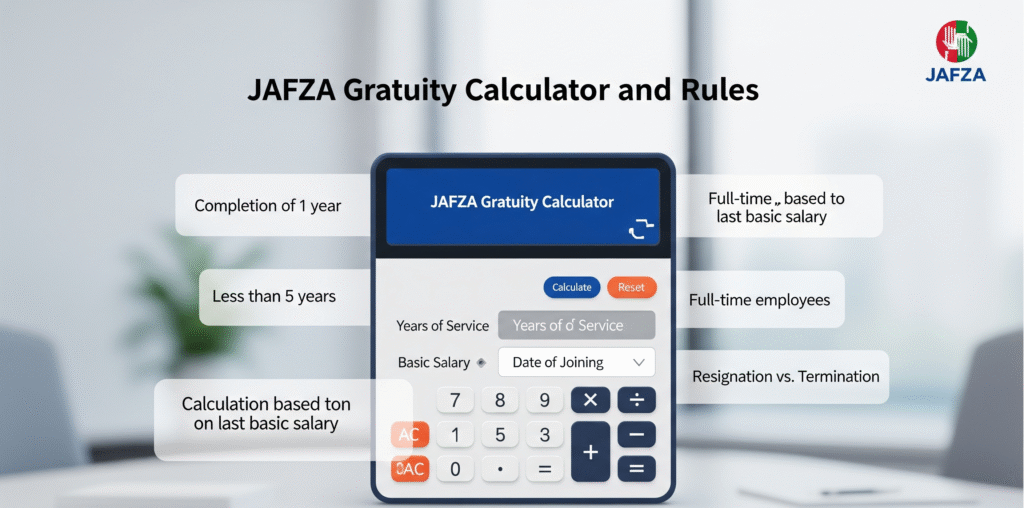

To be eligible for an end-of-service gratuity in JAFZA, you must have completed at least one full year of continuous service. If you resign or are terminated before completing 12 months of work, you are not entitled to a gratuity payment. This rule applies to most employees working for companies registered within JAFZA.

Minimum Service Requirement

The one-year threshold is absolute. Even if you have worked for 11 months and 29 days, you do not legally qualify for gratuity. The calculation begins only after you have crossed the one-year mark.

Limited vs. Unlimited Contracts: How They Affect Your Gratuity

Following the recent updates to the UAE Labour Law (Federal Decree-Law No. 33 of 2021), all companies in the UAE, including those in JAFZA, are required to move their employees to limited-term (or fixed-term) contracts. The deadline for this transition was February 2023.

Limited Contracts

These are employment contracts with a specific end date (e.g., for two or three years). Your gratuity is calculated based on a standard formula when the contract ends, is not renewed, or is terminated.

Unlimited Contracts

These contracts were open-ended and are now being phased out. If you are still on an old unlimited contract, your employer is legally required to transition you to a limited one. The gratuity calculation for these older contracts had different rules, especially upon resignation, but the new law standardizes the process under limited contracts.

How to Calculate Your JAFZA Gratuity?

This is the part everyone wants to know: how much will you get? Here, we break down the official formula and provide a clear, step-by-step example to help you estimate your entitlement.

The JAFZA Gratuity Calculation Formula

The calculation for gratuity is straightforward and is based on your last drawn basic salary (excluding any allowances like housing, transport, etc.).

Important Note: The total gratuity payment cannot exceed the equivalent of two years’ total wages.

JAFZA Gratuity Calculator

While the formula is simple, an online calculator can help you avoid errors and get a quick estimate. For a broader tool that covers various scenarios across the country, you can use a comprehensive Gratuity Calculator UAE to get a clear picture of your end-of-service benefits. To use a calculator accurately for your JAFZA situation, you will need the following information:

Gratuity Calculation Example

Let’s see how it works in practice.

Step 1: Calculate the daily basic wage. AED 10,000 / 30 days = AED 333.33 per day

Step 2: Calculate gratuity for the first 5 years. (21 days) x (AED 333.33/day) x (5 years) = AED 35,000

Step 3: Calculate gratuity for the remaining years (2 years in this case). (30 days) x (AED 333.33/day) x (2 years) = AED 20,000

Step 4: Calculate the total gratuity. AED 35,000 (first 5 years) + AED 20,000 (next 2 years) = AED 55,000

Fatima’s total gratuity entitlement is AED 55,000.

Final Settlement Calculation: What’s Included?

Your gratuity is a major part of your final payment, but it’s not the only component. Let’s look at everything that should be included in your full and final settlement.

Key Factors Affecting Your Gratuity Payment

Several factors can influence your final gratuity amount. Understanding these, from your reason for leaving to potential deductions, is key to ensuring you receive the correct payment.

Resignation vs. Termination

Under the new UAE Labour Law, the reason for ending the employment (resignation or termination) does not reduce your gratuity amount, provided you have completed at least one year of service. Whether you resign or your employer terminates your contract, the calculation formula remains the same.

Employer Deductions

An employer can only make deductions from your gratuity for amounts legally owed to them. They cannot arbitrarily reduce your gratuity payment for reasons like performance issues or as a penalty.

Gratuity Limit

As mentioned, there is a cap on the total gratuity amount. The final payment cannot exceed the total remuneration of two years’ service.

Special Cases and Considerations

While the general rules apply to most, there are some unique situations to consider. This section covers special cases like domestic workers and what to do if you face payment delays.

Gratuity for Domestic Workers in JAFZA

The UAE has specific laws governing domestic workers. While they are also entitled to an end-of-service gratuity, the calculation can differ. It’s best to consult the specific regulations for domestic workers or seek advice from the relevant authorities.

What to Do if Your Gratuity is Delayed

Your employer is legally required to pay your full and final settlement, including gratuity, within 14 days of your last day of employment. If your employer fails to pay on time or disputes the amount, you should first try to resolve it with them directly. If that fails, you can file a complaint with JAFZA’s labour affairs section, which will attempt to mediate the dispute.

Legal Support for Gratuity and End-of-Service Issues

Sometimes, disputes are unavoidable. If you find yourself in a disagreement with your employer over your final settlement, it’s crucial to know where you can turn for help.

Legal Services for Gratuity Disputes

If you cannot resolve a dispute amicably, seeking legal assistance is a wise step. An employment lawyer can provide clarity on your rights and represent you in negotiations or legal proceedings.

Common Legal Services:

Frequently Asked Questions (FAQs)

Conclusion

At the end of the day, gratuity is more than a number on paper—it’s recognition of your service and commitment. By using the JAFZA gratuity calculator and keeping the 2025 rules in mind, you can avoid confusion and make informed financial plans for your future. Whether you’re finishing up a short contract or wrapping up years of work, knowing your end-of-service benefits gives you peace of mind and control over what comes next.

Always keep a copy of your employment contract, know your basic salary, and track your service dates. By being informed, you can ensure a smooth transition and receive the full benefits you have rightfully earned. If you ever feel unsure, seeking expert advice is the best course of action.